Cooperative banks play a vital role in the financial ecosystem, particularly through innovative financial products like Cooperative Bank Chitty Schemes. These schemes allow members to pool their savings and access funds in a structured way, making them an attractive option for many individuals. By participating in a chitty, members not only save money but also gain the ability to secure loans when they need them most.

Co operative bank Chitty schemes offer various types, each designed to cater to different needs and preferences. Members can choose from regular chitties, which provide fixed monthly contributions, to flexible options that adapt to their financial situations. These schemes are not just about saving; they foster a sense of community and cooperation among the members, who all work toward common financial goals.

The framework governing these schemes ensures that they are safe and regulated, providing confidence to potential participants. With the right understanding, individuals can leverage these chitty schemes to enhance their financial stability and achieve their goals.

Key Takeaways

- Co operative bank chitty schemes enable members to save and access funds effectively.

- Various types of Cooperative Bank Chitty Schemes cater to different financial needs.

- Regulatory measures protect members and ensure the schemes operate safely.

Understanding Co operative Bank Chitty Schemes

Cooperative bank chitty schemes are savings and loan programs that allow members to contribute money and receive funds through a bidding process. These schemes promote saving among members while offering access to funds when needed.

Definition and Overview

A cooperative bank chitty is a financial arrangement where members regularly contribute a fixed amount. This pooled money is then distributed to members through a system of auctions or draws. Each member gets the chance to access a lump sum, depending on the bid they place.

These chitty schemes operate on trust and commitment. Members must honor their contributions consistently throughout the duration of the scheme. Chitty schemes help individuals save money and provide a source of funds for emergencies or planned purchases.

History and Evolution

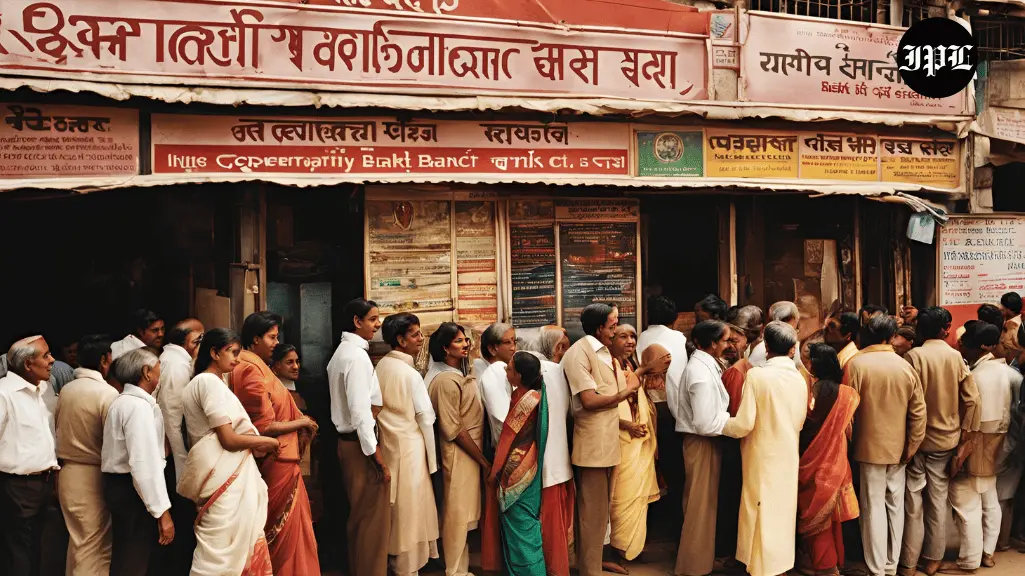

Cooperative Bank Chitty Schemes have roots in traditional savings practices in India, dating back many decades. They evolved from informal arrangements among friends and family to more structured schemes managed by cooperative banks.

As cooperative banks gained recognition, these chitty schemes became officially regulated. The Reserve Bank of India oversees these institutions, ensuring transparency and fairness. Over time, various modifications have helped modernize chitty operations, making them more accessible to a wider audience. This evolution reflects the growing importance of such schemes in promoting financial stability among members.

Types of Chitty Schemes

Chitty schemes offer different options tailored to various savings and investment preferences. Understanding these types can help individuals choose the right plan that fits their financial goals.

Recurring Deposit-Based Cooperative Bank Chitty Schemes

Recurring Deposit-Based Cooperative Bank Chitty Schemes require participants to make regular monthly contributions. This type of scheme is ideal for those who prefer a structured savings approach. Each contributor puts in a fixed sum monthly, which builds a collective fund.

The amount collected can later be auctioned among the members. This encourages saving while also providing the opportunity to receive a lump sum at once. Members often participate for specific tenures, ranging from 30 months to 120 months.

Fixed Tenure Cooperative Bank Chitty Schemes

Fixed Tenure Chitties have a set duration. Participants agree to join for a specific period, during which they contribute a specified amount each month. Once the tenure ends, the total amount collected is distributed among the members.

These schemes assure members that their savings will be returned in full at the end of the term. They are preferred by individuals looking for a predictable saving method with no surprises. Typically, the tenure ranges from two to ten years, allowing flexibility in choosing one that suits individual plans.

Variable Amount Chitties

Variable Amount Chitties allow participants to contribute different amounts each month. This scheme is ideal for those with fluctuating incomes or varying saving capabilities. It provides flexibility in how much one can save.

Members can adjust their contributions based on their financial situation, which helps to ease pressure during lean months. At the end of the term, the total pot is divided among the members based on the amount contributed. This approach encourages participation from a broader range of individuals, making it accessible for everyone.

Operational Mechanics of Cooperative Bank Chitty Schemes

Chitty schemes are a unique method of saving and borrowing money within cooperative banks. They involve members pooling their money together, with specific mechanics guiding their operation. This section reviews the enrollment process, monthly contributions, and how auctions and dividends function within these schemes.

Enrollment Process

To join a chitty scheme, interested individuals must first enroll with a cooperative bank that offers such schemes. The enrollment typically involves filling out an application form and providing identification documents.

Once accepted, members become part of a group where each individual is issued a unique member number. Minimum age requirements may apply, often set at 18 years.

Before starting, members should carefully review the terms and conditions of the chitty scheme. This ensures they understand their commitments and benefits.

Monthly Contributions

Members of a chitty scheme must make monthly contributions, which are crucial for the scheme’s operation. These contributions are collected from all members at a predetermined amount, typically based on the total value of the chitty.

For example, if there are ten members contributing $100 each, the total monthly pool becomes $1,000. This amount forms the basis for the auction process. Members must ensure timely payments, as delays can result in penalties or disqualification from future benefits.

Contribution frequency is usually monthly, lasting for a specific cycle defined at enrollment. Members must be aware of the total duration of the chitty scheme, ensuring they can meet their financial obligations.

Auction and Dividend Mechanism

The auction process is a key feature of chitty schemes. At the end of each month, members participate in an auction to bid for the pooled funds.

Each member can bid a portion of their entitlement, which is typically the total of their contributions. The lowest bid wins, and the member who wins receives the entire amount of money contributed that month.

In addition to the winning bid, dividends or bonuses are distributed among members based on their participation. These dividends are often influenced by the remaining funds after the winning bid is paid out. Remaining contributions are also considered, generating a return to members.

Members should keep track of their bidding history and potential returns, ensuring they maximize their benefits while participating in the chitty scheme.

Advantages of Investing in Cooperative Bank Chitty Schemes

Investing in chitty schemes offers unique benefits that combine the advantages of savings and credit. Participants can enjoy flexible payment options while having access to funds when needed.

Savings and Credit Dual Benefit

Co operative Bank Chitty Schemes provide a smart way to save money while also enabling access to credit. Participants pay a fixed monthly amount, which builds a collective fund. This fund can later be accessed by members through periodic auctions or draws.

- Regular Savings: Monthly contributions help establish a savings habit.

- Emergency Funds: Access to lump-sum amounts during financial needs is available.

- Low-Interest Loans: Funds can be borrowed at lower rates than traditional loans.

This dual benefit encourages financial discipline while also providing a safety net for unexpected expenses.

Flexibility and Liquidity

Flexibility is a major strength of Co operative Bank Chitty Schemes. Participants can choose the amount to invest and the duration that suits their needs.

- Customizable Plans: Monthly contributions can range from Rs. 1,000 to Rs. 6,00,000, allowing investors to find a suitable level.

- Duration Options: Chitties typically last between 30 to 120 months, making it easier to plan finances.

- Immediate Access: Participants can receive their savings sooner if they win the draw.

This combination of flexibility and liquidity makes Co operative Bank Chitty an attractive option for those looking to manage their finances effectively.

Regulatory Framework for Cooperative Bank Chitty Schemes

The regulatory framework for cooperative banks ensures that they operate within legal boundaries. It also plays a key role in protecting consumers’ interests in financial transactions. Understanding the governing bodies and consumer rights is crucial for transparency and accountability.

Governing Bodies and Regulations

Cooperative banks in India are primarily regulated by the Reserve Bank of India (RBI). The RBI enforces regulations to ensure that these banks manage their operations safely and soundly.

They are categorized into four tiers based on their deposit sizes:

- Tier 1: UCBs with deposits up to ₹100 crore

- Tier 2: UCBs with deposits over ₹100 crore and up to ₹1,000 crore

- Tier 3: UCBs with deposits over ₹1,000 crore

Each tier has specific regulations concerning capital adequacy, lending practices, and governance standards. Additionally, state governments also oversee cooperative banks through the Registrar of Cooperative Societies.

Consumer Rights and Protections

Consumers of cooperative banks are entitled to various rights and protections under the law. These include the right to fair treatment, transparency in information, and the ability to file complaints regarding services.

Cooperative banks must provide clear details about account terms, fees, and obligations. They are also required to address complaints within specified time frames.

Moreover, the Banking Ombudsman scheme offers an additional layer of protection. This scheme helps customers resolve disputes without going to court. Overall, these protections aim to foster trust and encourage responsible banking practices.

Frequently Asked Questions

This section covers key points related to cooperative bank chitty schemes. It includes details on the latest offerings, how to participate, differences between types of chitties, and regulatory oversight.

What are the latest Co operative Bank Chitty Schemes in 2024?

In 2024, several cooperative banks introduced new chitty schemes. These schemes often include different fixed tenures, varying subscription amounts, and flexible payout options. Members can choose plans that best suit their financial needs.

How can one participate in a co operative bank chitty scheme?

To participate in a cooperative bank chitty scheme, an individual must become a member of the bank. After membership, they need to select a chitty scheme and pay the required subscription amount regularly. Participation may also involve attending periodic meetings.

What are the differences between MDS chitty and typical cooperative bank chitty schemes?

MDS chitties are managed by specific organizations, focusing on a more structured approach. Typical cooperative bank chitty schemes may offer more flexibility in terms of contributions and payouts. The governance and management styles can differ significantly between these two types.

Are chitty schemes from cooperative banks like KSFE regulated by any financial authorities?

Yes, chitty schemes run by cooperative banks, including those like KSFE, are regulated by financial authorities like RBI. This regulation helps ensure transparency and protects the interests of the participants. Compliance with financial laws is mandatory for these banks.

How does participating in a cooperative bank chitty scheme different from taking a loan from a cooperative bank?

Participating in a chitty scheme often requires regular contributions, which can provide a lump sum payout after a set period. In contrast, taking a loan involves borrowing money with the obligation to repay it with interest. Chitty schemes can be less burdensome financially for some members.

What are the potential risks and benefits of investing in a cooperative bank chitty?

Investing in a cooperative bank chitty has benefits, including the potential for a larger payout and a sense of community among members. However, risks may include non-receipt of funds if the scheme is not managed well. Members should assess their risk tolerance before committing.